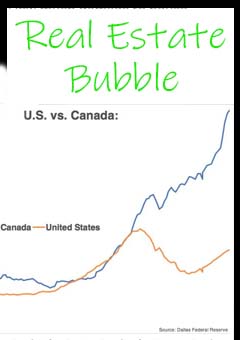

Taxes are going up, TO condo prices are going down and recreational property up 15% to 40% in the Canadian market.

Why are Interest rates not falling.

Goldman Sachs’ top AI picks

Does Printing Money Cause Inflation?

HSBC, the Untouchable Titan of Global Finance

US Economist’s Shock Warning: “Biggest Crash in Ou

Toni Gravelle Speech

Alberta Premier on the Supreme Court\'s ruling, an

What Bank of America Just Said is Shocking

Horrific Canadian Banking Corruption Right Before

The Banking System is in Free-Fall

The Financialization of Real Estate

The FDIC Threatens Downgrades That Will Cut Off Ac

Bitcoin regulations are coming

Are we in a bubble and, if so, when will it pop?

Canadian real estate and government, March 29

FIRE report January 12th

BOC and reconciliation with Indigenous people

Nov 26 FIRE report

FSIM FIRE report Nov 23

Nov 18th FIRE report

Poloz debunked, Nov 12 FIRE report

Central bank digital currencies: foundational prin

Nov 5th FIRE report

FIRE report November 2nd

Canadian real estate February 24

Real estate: Feb 9, bulls vs bears

Feb 1, The Dumb Money Real Estate Vid

January real estate report 2021

December 4th real estate report

Real estate, mortgage debt to income ratio improve

Real estate: fiscal conservatism/ponzi neoliberali

Caution for real estate investors, Oct 14th report

Canadian bank industry overview - part 1

Why insurance should partner with flood-claim.com

Canadian large bank comparison

Current state of fintech in Canada

XE.com explains their Big Data and AI strategy.

Greenpeace urges TD bank boycott

Insurance flood US vs Can comparison.

Canadian bank industry overview part 5

Canadian banking industry overview part 4

Part 3 Canadian bank industry overview

Canadian banking overview - part 2

Death to bitcoin, long live bitcoin

RBC to integrate Wave Technologies

Deposits have skyrocketed since the start of the p

About

About BankNews TV: financial services industry monitor (FSIM), analytics and research

Latest news and events for Canadian financial service companies, analytics, fintech and AI. BankNews.TV provide the latest technology news and reports for banks and insurance companies looking to compete in a rapidly changing market.

Financial data upload

Analytical information and financial information related to technogies that can change your business.

Financial data templates

Please download and complete the data template that you need to upload. See financial data upload section above for details of how this data will be used.

| capital_and_leverage | capital_and_leverage |

| derivative_contracts | derivative_contracts |

| impaired_assets | impaired_assets |

| income_statement | income_statement |

Research

Part 2: The Merchant Loyalty Industrial Complex Collapse

fsim.ca/docs/Credit_cards_Part_2v4.pdf

Mark Sibthorpe

Since November 2, 2021, Loyalty Ventures Inc.'s (Airmiles) market cap has decreased from $861.42M to $2.11M, a decrease of -99.75%. This compares closely to 2018, when Aimia sold Aeroplan back to Air Canada and partners TD and CIBC for $238 million. For reference, in 2005 Aeroplan launched an IPO valuing it at $2 billion. Related to Aimia’s downfall, it had also previously sold the UK Nectar program to Sainsburys for $120 million, $580 million lower than it paid for Nectar in 2007.

This report digs under the surface and uncovers why loyalty is going the way of the dodo.

Merchants should not waste time fighting card networks

fsim.ca/docs/Card_fees_ongoing.pdf

Mark Sibthorpe

This is part one of a two part assessment of merchant frustration due to high credit card fees. The second part of this report will outline an alternative approach that merchants can consider. An approach that is a win for them and also for the card networks.

The full story of SVB March 12th, 2023

fsim.ca/docs/SVB_special_report2.pdf

Mark Sibthorpe

Aggregated news and research related to SVB. Apart from SVB, included in this report is related news with respect to other banks and non-traditional companies looking to add financial services that also appear risky.

March 2023 bank earnings summary

fsim.ca/docs/bankearningsfriday.pdf

Mark Sibthorpe

This report provides a snapshot into recent bank earnings and related news as published in fsim.ca reports.

Real estate report: October 30th, 2020

fsim.ca/docs/Oct30rereportv1.pdf

Mark Sibthorpe

The big buzz in real estate recently is Mark Carney being scooped up by Brookfield. This means more juice for riskier borrowers. Brookfield, a huge player in real estate, both residential and commercial, recently bought its remaining shares from Sagen (Genworth MI Canada), which values the company at $3.8 bn.

VersaBank’s New High-Security VPN Proving Especially Valuable During COVID-19 Pandemic

fsim.ca/docs/TailscaleReleaseMarch30FINAL.pdf

Press Release

2014 FSIM when Bernanke visited Montreal

fsim.ca/docs/MockBernanke.pdf

Mark Sibthorpe

Considering Bernanke is hated by the Republicans and hated even more by the Democrats, and is currently under scrutiny for saving AIG but not Lehman, (in hindsight) with respect to issues over solvency vs liquidity, the Montreal lovefest attended by 1,100 people yesterday must have been a welcome respite. Click the link to read the entire 2014 report.

Eisman's big Canadian bank short

fsim.ca/docs/eisman2.pdf

Mark Sibthorpe

I have been reporting on Steve Eisman's short position for quite some time. As the analyst reaction to Eisman shows (link below), Eisman has taken a lot of heat for shorting Canadian banks. Instead of capitulating, in September 2019 he publicly disclosed the fact that he added Canadian Tire to his position, He explains the rationale for this in a BNN interview late 2019. Essentially, his big concern with respect to banks was non-performing loans in Alberta. He feels Canadian bank CEOs are not prepared for a credit cycle. He specifically referenced ATB (a private bank) in discussing his concerns. Looking at the numbers today, my guess is that he has made off like a bandit.

VersaBank Beta-Testing Its New, High Volume Mortgage Finance App

fsim.ca/docs/VBCortelMortFinanceAppFeb62020.pdf

Press Release

VersaBank announces it is initiating beta-testing on its newly developed high-volume mortgage software app with the Cortel Group, one of Canada’s largest home and condominium builders. The app, named “Direct Connect”, was designed to facilitate and significantly reduce the lengthy finance approval process typically experienced by home buyers when visiting home and condo pre-construction sales offices.

How and why you need to defend your brand against disruptors

Mark Sibthorpe

Technology, and being open to opportunities, has preempted transformation in banking. At the top of change are Mint, PayPal and ApplePay; three examples of transformative solutions that are now ubiquitous. On the horizon: Uber and Google, both having recently announced partner based banking services. Further down in the plumbing is Duca Impact Labs, Versabank, and Revolut. This report shows how cost conscious FIs can, not only stay relevant in the face of adversity, but punch well above their weight. All thanks to creative thinking and the ongoing commoditization of technology.

Kick the can(nomics)

fsim.ca/docs/Kick.pdf

Mark Sibthorpe

Canada has used consumer debt to provide life support to the economy. This strategy which basically pushed the day of reckoning to the next government was old back in 2014, and now is well past its sell-by-date. Recognizing this, and desperate to keep the economy out of a recession, Trudeau is spending more money now than any government in Canadian history. This report disusses a possible alternative.

ScoreCard Bill Morneau, Canada's Minister of Finance

fsim.ca/docs/ScoreCardMorneau.pdf

Mark Sibthorpe

This report is a scorecard I designed in order to rank the performance of the current Minister of Finance, Bill Morneau. I do regular rankings because, otherwise, I cannot measure the performance in a meaningful way. The scoring is based on a variety of metrics as detailed on the ‘score-table’ on page 3. Examples of the criteria and weighting include:

Observations and overview of 2018 NB flood support from government and insurance companies.

fsim.ca/docs/Observations and overview of 2018 NB flood support from government and insurance companies..pdf

Mark Sibthorpe

Flood aftermath is linked to post traumatic stress. Here are some findings from a study conducted by Queensland University following a flood:

"The findings showed that aftermath stress contributed to poor mental health outcomes over and above the flood itself, prior mental health issues and demographic factors," Ms Dixon said.

"Aftermath stress was the strongest predictor of post-traumatic stress symptoms with 75 per cent of people saying the most difficult aspect was the aftermath and dealing with insurance companies," she said.

With this in mind, I felt it was important to understand how New Brunswick flood victims were treated.

Update Argentina: a sign of the times

fsim.ca/docs/Update Argentina_ a sign of the times.pdf

Mark Sibthorpe

Argentina is in the news daily because the situation is dire, and may be an indication of further contagion. The most dramatic story that speaks of the a leading cause of its troubles was the recent arrest of the public works secretary, Jose Lopez. June 15th he was caught hiding millions in cash in a monastery. No this is not a plot for a comedy.

Summary of Canada's flood news, 2017 to present

fsim.ca/docs/Summary-of-flood-news-2017-present.pdf

Mark Sibthorpe

This report covers flood news in Canada from 2017 to present and highlights the relevent issues for home-owners and the insurance industry.

Banking on Pot

fsim.ca/docs/c10191_banking-on-pot.pdf

SBS

As states across the US legalize marijuana for both medicinal and recreational purposes, it has fueled a growing industry of marijuana related businesses (MRBs).

Canadian banking industry overview

Mark Sibthorpe

The industry overview is divided into 5 parts:

Introduction

Small banks

Small medium sized banks

Medium sized banks

Medium large banks

2014 Mobile payments the Apple pay way

fsim.ca/docs/Mobile_Payments_Apple_Pay_2014.pdf

Mark Sibthorpe

With Walmart Pay about to userp Apple Pay, I thought I would share my 2014 book on mobile payments and loyalty. The guilde was written for Merchants that want to understand loyalty, credit, mobile payments and Apple Pay, but anyone involved with credit and loyalty might find it useful.

The book is a prelude to Walmart leaving MCX, and chronicles the evolution that led to Walmart Pay. There is an extensive case study of Walmart that looks into its efforts to become an ILC and to avoid paying credit card transaction fees ('merchant discount').

It offers readers a step-by-step methodology for evaluating and transforming credit and loyalty programs. The strategies are based on proven examples and industry facts. The Nectar, Target, Canadian Tire and Walmart case studies are examples of the practical approach I have taken, written with the intent that merchants can use them as blueprints for their own initiatives.

Death to bitcoin, long live the blockchain (See full report)

Mark Sibthorpe

Jamie Dimon calls bitcoin a fraud used by criminals, yet he has jumped into the blockchain with both feet.

TD bank industry conduct

fsim.ca/docs/tdind2.pdf

Mark Sibthorpe

TD’s share price recently collapsed by $7 bn in one day due to CBC’s allegations of aggressive selling tactics. A huge fall from a bank that was trading at a premium as recently as January. This was even before the most recent allegation of TD attempting to avoid paying taxes on advertising.

This report chronicles the events leading up to the collapse, shows TD's performance, analyses other related issues.

Book review: Back from the Brink

fsim.ca/docs/backbrink.pdf

Mark Sibthorpe

This is a book review of the book Back from the Brink by Paul Halpern, Caroline Cakebread, Christopher C. Nicholls and Poonam Puri.

Footnote 151

fsim.ca/docs/footnote151.pdf

Mark Sibthorpe

Footnote 151 implies an important regulatory change related to derivative contracts. It means that US Banks will not be required to hold as much capital against commodities. If you want to understand the implications of this regulatory change in more detail, see the enclosed related article detailing the changes. For contextual purposes, I have also included two Rolling Stones Magazines reports from 2010 and 2014 that chronicle the role large US banks have played in manipulating commodities. You might question the credibility of these sources, but rest assured, these reports are based on United States Senate hearings which outline the issues in a 396 page report related to the implied risks.

Save the Canadian economy now

fsim.ca/docs/helecopter-money.pdf

Mark Sibthorpe

Consumer debt spending appears to have insulated Canada from the worst of the credit crisis, but now the alarming magnitude of consumer debt ($1.92-trillion) could exacerbate a day of reckoning.

This report assesses the issues at hand and recommends the solution to get Canada's economy on track.

Reasons financial service companies should consider gamification

fsim.ca/docs/GamingEventProposal-printsample--en-final.pdf

Mark Sibthorpe

Gamification of business processes resulted on Mint.com growing to 10 million users within 4 years. This report explains how.

National Bank Special Report

fsim.ca/docs/NatBSpec.pdf

Mark Sibthorpe

According to Bloomberg, National Bank of Canada will take a C$64 million ($48 million) restructuring charge in the fourth quarter and said its investment in Maple Financial Group Inc., which is being probed by German regulators, may be at risk of a “substantial loss.”

Will Canadian banks charge companies for deposits?

fsim.ca/docs/depgrowthimpact2.pdf

Mark Sibthorpe

In light of today’s possible rate cut, this report discusses how a bank rate cut and capital ratio pressure could precipitate negative corporate deposit interest rates in Canada.

Canadian Tire's (CTC) - Canadian Tire Financial Services (CTFS) Scotia deal overview and risk assess

fsim.ca/docs/ctfsfinal.pdf

Mark Sibthorpe

Review of the Canadian Tire Financial Services deal with Scotiabank, risks, opportunity and benefits.

Finance minisiter scorecard August 26, 2015

fsim.ca/docs/Scorejo-August-2015.pdf

Mark Sibthorpe

This report looks at Joe Oliver, minister of finance’s progress to date, and assigns a grade to his government’s performance to date.

Xtreme Branch

fsim.ca/docs/xbranch.pdf

Mark Sibthorpe

Branches are evolving to meet the digital age. This documents tracks the evolution with real-world examples.

Canadian Nudge

fsim.ca/docs/nudge.pdf

Mark Sibthorpe

CWB cause for concern

fsim.ca/docs/cwbupdate.pdf

Mark Sibthorpe

BNTV Overview

fsim.ca/docs/overviewpdf.pdf

BNTV

BankNews.TV Publishing Corp services overview document:

- Analytics

- Financial services industry monitor (FSIM) industry briefings and developments reports

- Research

Challenger banks not a threat to big banks

fsim.ca/docs/challenger.pdf

Mark Sibthorpe

This report looks at Canadian challenger banks (apart from merchant led banks) and explains why they have not threatened larger institutions. It also looks at ways in which these upstarts have achieved success.

Gamification of financial data project

fsim.ca/docs/GamingEventProposal-printsample--en-final_original.pdf

Mark Sibthorpe

This document contains details on how BankNews.TV is helping kids learn programming via gamification of financial data.

The impact a rate rise will have for Canadian banks

fsim.ca/docs/irr-f.pdf

Mark Sibthorpe

Canadian banks have made money throughout the credit crisis, but this trend may be about to reverse. The rational supporting this prediction is that revenue has grown despite a declining net interest margin (NIM). It has grown in spite of this fact because Canadian debt (loan lease volume) has risen significantly, as shown in chart 2.

FIFA: the new goldenballs

fsim.ca/docs/goldenballs.pdf

Mark Sibthorpe

Yesterday, the Attorney General of Switzerland (OAG) opened criminal proceedings related to the FIFA scandal. This report outlines some of the events related to the criminal investigation, with a particular focus on banking.

Scorecard Minister of Finance: JIm Flaherty

fsim.ca/docs/Scorecard Min Fin Flaherty April 8 2014.pdf

Mark Sibthorpe

March 18, Finance Minister Jim Flaherty resigned from cabinet after having endured a difficult year due to health issues. This report looks at his legacy and attempts to grade his government’s performance to date.

Merchants extend financial services

fsim.ca/docs/merchantfs.pdf

Mark Sibthorpe

Merchant led financial services are growing in importance once again. This is exemplified in the ongoing UK rivalry between ASDA, Sainsbury and Tesco. Together these merchant/financial service companies provide the backstop for three different approaches for merchants looking to extend their financial services.

Hot Money: real-estate

fsim.ca/docs/hotmoney.pdf

Mark Sibthorpe

Currency Cheat Sheet: a guide for the rest of us

fsim.ca/docs/currencycheatsheet.pdf

Mark Sibthorpe

Riches to Rags? Summary of possible risks for Genworth MI CANADA, INC.

fsim.ca/docs/gq4risk.pdf

Mark Sibthorpe

Genworth had its Q4 2014 earnings call. Genworth own about 30% of the mortgage default insurance in Canada. Not surprisingly, the earnings call became focussed on Alberta; and for good reason, with 20% of its outstanding insured mortgage balance in Alberta, sensitivity to the oil shock and how Genworth plan to manage related risks were discussed in detail.

Canadian Western Bank Competitive Forecast

fsim.ca/docs/cwbf.pdf

Mark Sibthorpe

Based on historical financial data (see detailed charts pages 5-8), the oil based recession in Alberta, and comparison against two of its peers, this document outlines my observation with respect to CWB’s future performances.

Liquid Canada: the tipping point

fsim.ca/docs/Liquid.pdf

Mark Sibthorpe

This report examines liquidity issues in the Canadian financial service industry.

Bank Fees

fsim.ca/docs/Bank fees.pdf

Mark Sibthorpe

Recently the CBC and The Globe and Mail both reported on what has been referred to as a consumer “bank fee outcry”. CBC compares banks to cable and phone companies, standing accused of trying to gouge customers with service fees. The backlash appears to have originated in conjunction with the NDP and the Consumers Council of Canada which argues that there is anxiety ‘among consumers about banking fees’.

Cheap Oil Report

fsim.ca/docs/co2.pdf

Canada's Economy, a strategic solution

fsim.ca/docs/ces.pdf

Mobile Payments Blueprint: guide to credit and loyalty transformation for merchants

fsim.ca/docs/booksample.pdf

Guide to system selection

fsim.ca/docs/gssnow.pdf

Read sample report: Guide to system selection. This sample would normally cost $99 but is available free as a sample. Click here view sample report.

News feed

CANADA WILL FINALLY ALLOW BANKS TO SHARE DATA ABOUT CROOKED CLIENTS TO COMBAT FINANCIAL CRIME

G&M - Rita Trichur (2024-04-19)

As outlined in the federal budget, Ottawa plans to increase permissible information sharing among financial institutions so that they can better detect and deter money laundering, terrorist financing and sanctions evasion. At

MORE TD BANK SHAREHOLDERS DEMAND 'CREDIBLE' DETAILS ON CLIMATE CHANGE PLANS

Yahoo Finance - Jeff Lagerquist (2024-04-19)

The proposal received support from 28.6

TFSAS, RRSPS AND MORE COULD SEE CHANGES IN ALLOWED INVESTMENTS

Melissa Shin (2024-04-19)

Holding a non-qualified or prohibited investment can lead to severe tax consequences: the plan would incur a 50% tax on the fair market value of the non-qualified or prohibited investment at the time it was acquired or changed status, and the investmentâs income also would be taxable.

HIGH-SPEED TRADER JANE STREET RAKED IN $4.4BN AT START OF 2024

FT - Eric Platt (2024-04-19)

Jane Streetâs quarterly trading revenues have surged to their highest level since the start of the pandemic, as the secretive high-speed firm flourished alongside traditional Wall Street market makers. The

BLACKSTONE WARNS THAT PRIVATE EQUITY CANNOT RETURN CAPITAL ‘OVERNIGHT’

FT - Antoine Gara (2024-04-19)

Blackstone has said it will take time for private equity firms, which are sitting on record amounts of unsold assets, to return cash to investors even as the market for mergers and acquisitions comes back to life. âI

UK SMART DATA ROADMAP UNVEILED

Finextra (2024-04-19)

Kevin Hollinrake, UK Minister of State for Enterprise, Markets, and Small Business, said: âThe data economy is a large and growing part of the economy.

CANADA'S REAL-TIME PAYMENT SYSTEM WON'T LAUNCH BEFORE 2026

Finextra (2024-04-18)

However, the second piece of the project, building the real-time clearing and settlement component, is not yet finished.

BERNANKE CALLS FOR TOTAL REDESIGN OF BOE FORECASTING

Central Banking (2024-04-18)

The former US Federal Reserve chairâs review of the BoEâs forecasting found the bankâs core model, Compass, has âsignificant shortcomingsâ and may have to be replaced.

VIRTUAL INVESTOR MEETINGS ARE ERODING SHAREHOLDER RIGHTS, ADVOCATES WARN

G&M (2024-04-18)

Two recent cases are especially notable.

CIBC CUSTOMERS DINGED WHEN BANK ADDS $5 FEE TO E-GIFT CARDS, CALLING THEM A 'CASH ADVANCE'

CBC - Erica Johnson, Kimberly Ivany (2024-04-18)

Murphy called CIBC to inquire about the extra charges and after a lengthy conversation with a customer service rep learned they were "cash advance" fees, charged every time anyone purchased a gift card that is sold by a company called CashStar.

BANKS TOLD TO ANTICIPATE RISKS FROM USING AI, MACHINE LEARNING

Reuters (2024-04-18)

Banks must anticipate risks from using artificial intelligence (AI) and machine learning (ML) in their operations as part of their day-to-day governance, a top global banking regulator said on Wednesday. There

CANADA’S NEW HOUSING PLAN WON’T HELP, BUT SLOWING IMMIGRATION WILL

Better Dwelling (2024-04-18)

Canada just announced billions in new measures to correct the housing issues it created.

CANADA SEES DOMESTIC & FOREIGN INVESTORS PULL OUT AT A RECORD PACE

Better Dwelling (2024-04-18)

Canadians werenât leading the trend, but joining the global capital flight from the country.

REVOLUT VALUATION RAISED 45% BY INVESTOR

Finextra (2024-04-18)

Revolut is hoping to gain a significant share of the huge cross-border remittance market in Mexico - worth around $63 billion last year - but stresses it plans to offer a "wide range of financial products and services".

TD BANK CEO ASKS SHAREHOLDERS FOR PATIENCE AS U.S. REGULATORY PROBE STRETCHES INTO SECOND YEAR

G&M - Stefanie Marotta (2024-04-18)

âWithout a doubt, shareholders have some anxiety regarding our issue in the U.S.,â

US REGIONAL BANKS SEEN BOOKING MORE COMMERCIAL PROPERTY LOSSES, LOAN SALES

Yahoo Finance - Saeed Azhar and Matt Tracy (2024-04-17)

"I expect to see more of a reserve buildup," said Stephen Buschbom, research director at consultancy Trepp.

G20 WATCHDOG SAYS 'NON-BANKS' SHOULD HOLD MORE CASH TO COPE WITH MARGIN SPIKES

Yahoo Finance - Huw Jones (2024-04-17)

"Non-banks" such as insurers, hedge funds, family offices and commodities traders should hold sufficient cash and draw up contingency plans for coping with spikes in collateral used to back derivatives positions against default, the G20's financial watchdog proposed on Wednesday.

CANADA'S INTEREST RATES WILL LIKELY FALL. WHERE WILL THEY END UP?

Yahoo Finance - John McFarlane (2024-04-17)

âThese cuts are getting further and further away and getting smaller and smaller, creating a situation of higher for longer, because the economic data that are coming in are coming in a little hotter than expected,â Avigdor said.

CANADA HIKES CAPITAL GAINS TAX TO RAISE BILLIONS FOR HOUSING

Bloomberg - Erik Hertzberg (2024-04-17)

Canada will raise capital gains taxes on businesses and wealthy individuals to help pay for tens of billions in new spending aimed at making housing more affordable and improving the lives of young people. Finance

CANADIAN INFLATION HEADS IN THE WRONG DIRECTION, BROAD BASED GROWTH

Better Dwelling (2024-04-17)

Gas and shelter costs drive inflation 4.9%

BUDGET 2024 PLEDGES $53B IN NEW SPENDING

Investment Executive (2024-04-17)

To pay for some of the new spending on things like housing and national defence, the Liberal government is increasing taxes on some asset sales profits.

PRIVATE CREDIT IS EVEN LARGER THAN YOU THINK

FT - Robin Wigglesworth (2024-04-17)

Private credit is now so big that the IMF dedicated an entire chapter in its latest Global Financial Stability Report to its ârise and risksâ.

GOLDMAN SACHS KNOWS WHAT FITS IT BEST — PLENTY OF DEALS

FT (2024-04-17)

Goldman Sachs has reminded us what it does best, even if that may not get the pulses of its shareholders racing.

CFIT ADVANCES OPEN FINANCE PILOTS FOR CONSUMERS AND SMES

Finextra (2024-04-17)

The initial SME PoC with HSBC demonstrated that accessing new datasets and auto-populating business loan applications can lead to a significant boost in SME lending decisions.

OTTAWA HAS TAPPED CANADA’S FINANCIAL CONSUMER WATCHDOG TO OVERSEE THE COUNTRY’S PROPOSED OPEN BANKING REGIME

G&M (2024-04-17)

Open banking is a term for a new set of rules that would enable financial institutions to â at the request of their customers â exchange information more efficiently and securely.

STEPHEN POLOZ WILL LEAD PUSH TO BOOST DOMESTIC INVESTMENT BY CANADIAN PENSION FUNDS

G&M (2024-04-17)

The working group is being created to âexplore how to catalyze greater domestic investment opportunities for Canadian pension funds,â the government announced in its budget document released Tuesday, and Mr.

MORTGAGE INTEREST STILL DRIVING INFLATION, AS OVERALL RATE NUDGES UP TO 2.9%

CBC - Anis Haydari (2024-04-17)

The inflation rate for services, such as air transportation, was up by 4.5

AT THE HEART OF CANADA’S PRODUCTIVITY CRISIS: WE UNDERINVEST IN EMPLOYEES

G&M - Jeffrey Doucet (2024-04-16)

The reasons behind this decline are multiple but are centred on a lack of business investment.

THE DIRTY SECRET OF THE HOUSING CRISIS? HOMEOWNERS LIKE HIGH PRICES

CBC - Andre Mayer (2024-04-16)

"There are multiple things we need to do [to reduce prices], and more supply is one of them," said Kershaw.

CANADA'S INTEREST RATES WILL LIKELY FALL. WHERE WILL THEY END UP?

Yahoo Finance - John McFarlane (2024-04-16)

âThese cuts are getting further and further away and getting smaller and smaller, creating a situation of higher for longer, because the economic data that are coming in are coming in a little hotter than expected,â Avigdor said.

CANADIAN DOLLAR COULD 'CRATER' IF BANK OF CANADA CUTS FASTER AND DEEPER THAN THE FED, SAY ECONOMISTS

Yahoo Finance (2024-04-16)

âPushing out Fed rate cuts makes it more difficult for the Bank of Canada to ease without causing CAD (the Canadian dollar) to crater,â Derek Holt, vice-president and head of capital markets economics at Bank of Nova Scotia, said in note to investors following the interest rate announcement.

JPMORGAN ANALYSTS SAY CAUTIOUS CALL ON EUROPEAN BANKS WAS WRONG

Yahoo Finance (2024-04-16)

Favorable economic and interest rate trends have helped drive a 16% price-to-earnings improvement across the sector, a team led by Kian Abouhossein wrote in a note Tuesday.

REAL ESTATE OPTIMISM SURGES IN CANADA WITH RATE CUTS ON HORIZON

Bloomberg (2024-04-16)

Canadians are growing bullish on housing again. Nearly

WHAT’S THE BASIS TRADE? WHY DOES IT WORRY REGULATORS?

Bloomberg - Ye Xie and Liz Capo McCormick (2024-04-16)

A trading strategy used by hedge funds to exploit discrepancies in the US Treasuries market is causing headaches for market regulators.

SAXO BANK EXPLORES STRATEGIC OPTIONS INCLUDING SALE

Reuters (2024-04-16)

Denmark's Saxo Bank is exploring a possible sale, 18 months after talks to merge with a blank-cheque company fell apart, four people familiar with the matter told Reuters. The

FEDS PROPOSE LOAN PROGRAM FOR SECONDARY SUITES

Investment Executive (2024-04-16)

Ottawa said the secondary suite loan program will help increase housing density to make the most of available space in communities across the country.

WHY THE SHADOWY CREDIT SCORE INDUSTRY SHOULD NOT EXIST

G&M (2024-04-15)

Rob Csernyik is a 2022 Michener-Deacon fellow and a contributing columnist for The Globe and Mail. Several

LIBERAL PLAN TO BUILD 3.87 MILLION HOMES BY 2031 INCLUDES NEW PLEDGE TO STEM REAL ESTATE FRAUD

G&M (2024-04-15)

The federal Liberals capped off a run of prebudget housing announcements with new pledges on Friday, including plans to crack down on mortgage and real estate fraud, to restrict the purchase of single-family homes by large, corporate investors and to provide low-interest loans of up to $40,000 for secondary suites. The

HOW A BALLOONING PUBLIC SECTOR IS RESHAPING CANADA’S ECONOMY

G&M (2024-04-15)

Two years into the pandemic, as the public sector outpaced the private sector in creating jobs, concerns about the trend could fairly be countered by pointing to the festering wounds inflicted on the economy by the lingering health crisis.

HOW TO INSURE DEPOSITS OVER $250,000

Yahoo Finance (2024-04-15)

Joint accounts are one ownership category, but you can have other categories, such as individual accounts, retirement accounts, and trusts.

WHY EVERYONE IN FINANCE IS GETTING RIPPED

Bloomberg (2024-04-15)

Graham Ambrose has never felt stronger.

BLACKROCK ASSETS HIT RECORD $10.5 TRILLION AS MARKETS SURGE

Reuters (2024-04-15)

BlackRock's AUM surged 15% in the first quarter from a year earlier, while investment advisory and administration fees, typically a percentage of AUM and the company's chief source of revenue, climbed nearly 8.8%

OSFI LIMITING LEVERAGE IN BANK MORTGAGE PORTFIOS

Investment Executive (2024-04-15)

The Office of the Superintendent of Financial Institutions says the loan-to-income limit on new uninsured mortgages will help reduce the risk of borrowers being unable to pay their loans. Because

BANK OF CANADA DECISION: DID WE LEARN ANYTHING NEW?

Mortgage Broker News (2024-04-15)

Laird told Canadian Mortgage Professional that the Bank appeared to be keeping its powder dry for the moment, possibly due to concerns that a premature cut could jeopardize its battle against inflation.

MANULIFE BANK HIRES TD BANK EXECUTIVE AS CEO

G&M (2024-04-12)

Manulife Bank, a unit of life insurer Manulife Financial, has appointed Katy Boshart as its CEO, starting next week. Boshart

HOW CANADA’S HOUSING OBSESSION IS CANNIBALIZING ECONOMIC PRODUCTIVITY

G&M (2024-04-12)

Canadaâs poor productivity performance has now been characterized as a national emergency.

RBC FIELDS SHAREHOLDER QUESTIONS ON CLIMATE AND INDIGENOUS RIGHTS AT ANNUAL MEETING

G&M (2024-04-12)

Dave McKay says the lender is continuing to assess its climate change impact, responding to a parade of questions on Thursday from shareholders on the environment and Indigenous rights. The

FIRST-TIME HOMEBUYERS CAN GET 30-YEAR MORTGAGES TO BUY NEWLY BUILT HOUSES UNDER RULE CHANGE

G&M - Rachelle Younglai (2024-04-12)

Ottawa will allow first-time homebuyers to take out 30-year mortgages for newly built homes, relaxing rules as the federal government faces political pressure to ease the countryâs housing crunch. The

GICS VS. EQUITIES: HOW INVESTORS SHOULD PLAY THE ELUSIVE DROP IN INTEREST RATES

Yahoo Finance - John MacFarlane (2024-04-12)

âYes, we're hearing conversations of, this is going to happen, rates are going to be moving down,â said Kalee Boivert, a Calgary-based financial advisor with Raymond Jones.

140 BMO CUSTOMERS SAY THEY LOST $1.5M IN TRANSFER FRAUDS, PLAN TO SUE BANK

CBC (2024-04-12)

But before they could, they say someone accessed their Bank of Montreal account without authorization in late 2022 and withdrew more than $63,000 through a series of transfers that the bank won't reimburse.

ECONOMISTS CONFIDENT EURO ZONE INFLATION WILL FALL TO 2% - ECB POLL

Reuters (2024-04-12)

The ECB held interest rates at a record high on Thursday but signalled it could start cutting as soon as June, even though stubbornly high U.S.

ECB CANNOT IGNORE FED AS IT GOES DOWN ITS RATE CUT PATH

Reuters - Francesco Canepa and Balazs Koranyi (2024-04-12)

The ECB is sticking to plans to reduce interest rates from record highs, likely at its next meeting in June, in light of a continued fall in inflation in the 20 countries that share the euro. ECB

RBC TIGHTENS SECURITY AS PROTESTERS RALLY OUTSIDE ANNUAL MEETING

Bloomberg - Christine Dobby (2024-04-12)

Royal Bank of Canadaâs annual shareholder meeting was dominated by questions about its financing of fossil-fuel businesses as dozens of protesters rallied outside the gathering. The

FEDS BOOST HOME BUYERS PLAN WITHDRAWAL LIMIT TO $60,000

Investment Executive (2024-04-12)

âWhen you add the $60,000 [from the HBP] on top of $40,000 [of maximum FHSA contribution] â and over 15 years, you can probably double [the FHSA] with a reasonable rate of return â now youâre looking potentially at $140,000.

BANK OF CANADA HOLDS RATE STEADY, SAYS JUNE RATE CUT A POSSIBILITY

G&M (2024-04-11)

The Bank of Canada kept its policy interest rate steady for the sixth consecutive time but opened the door to monetary-policy easing in the coming months, with Governor Tiff Macklem acknowledging that a June rate cut is on the table. The

THE WORST PART OF A WALL STREET CAREER MAY BE COMING TO AN END

G&M (2024-04-11)

Pulling all-nighters to assemble PowerPoint presentations.

TRADERS LIGHTEN BETS ON JUNE RATE CUT: HOW MARKETS AND ECONOMISTS REACTED TO THE BOC DECISION

G&M (2024-04-11)

Market bets for when monetary easing will arrive in Canada fluctuated widely in trading this morning as the nationâs central bank /n and provided its latest guidance on what may lie ahead. Implied

WHY YOU CAN’T AFFORD A HOME, EXPLAINED IN 10 CHARTS

G&M (2024-04-11)

You earn the median household income of roughly $85,000 a year before tax and youâre looking to purchase an $800,000 home â a standard national price of late.

TRADERS FLEE REAL ESTATE STOCKS AS INFLATION DARKENS OUTLOOK

Bloomberg - Noran Mulinda (2024-04-11)

Investors dumped real estate stocks after a hotter-than-expected US inflation reading quashed expectations for an imminent break from elevated interest rates. An

SWITZERLAND LAYS OUT NEW TOO-BIG-TO-FAIL RULES IN WAKE OF CREDIT SUISSE BANKING TURMOIL LAST YEAR

Investment Executive - Jamey Keaten (2024-04-11)

Swiss authorities feared last year that the collapse of such a major lending institution as Credit Suisse could further roil global financial markets following the failure of two U.S.

JPMORGAN'S DIMON STRESSES 'CRITICAL' IMPACT OF AI

Finextra (2024-04-11)

"In the future, we envision GenAI helping us reimagine entire business workflows," writes Dimon, adding that the technology "has the potential to augment virtually every job".

CANADIAN BANKS CAUGHT IN ESG BACKLASH FROM U.S. STATE OFFICIALS

G&M - Jeffrey Jones (2024-04-10)

Two Canadian banks are in the crosshairs of an anti-ESG U.S.

CAISSE RACES TOWARD SUSTAINABILITY TARGETS BUT SAYS COMPANY DATA TO MEASURE EMISSIONS FROM INVESTMENTS IS STILL LACKING

G&M - James Bradshaw (2024-04-10)

The Caisse de dépôt et placement du Québec is reaching its targets to cut carbon emissions from its $434-billion investment portfolio years ahead of schedule, but much of the hardest work is still to come. The

LOAN GUARANTEES MUST ALLOW FOR INDIGENOUS OWNERSHIP OF OIL AND GAS DEVELOPMENTS

G&M (2024-04-10)

Just as much-needed energy projects in the U.S.

SEVERAL CANADIAN BANKS RANK HIGH GLOBALLY FOR AI RESEARCH

G&M (2024-04-10)

Canadian banks hold three of the top 10 spots worldwide for artificial-intelligence innovation, according to a new ranking. Royal

ROYAL BANK OF CANADA’S DECISION TO TERMINATE NADINE AHN WILL COST THE BANK’S NOW-FORMER CHIEF FINANCIAL OFFICER MILLIONS OF DOLLARS.

G&M (2024-04-10)

The companyâs proxy circular describes âcauseâ as âfor reason of misconduct, gross negligence or willful breach of obligations.â In

FORMER BOC GOVERNOR MARK CARNEY WARNS OF ‘SLOWER AND SHALLOWER’ RATE CUTS

G&M (2024-04-10)

Former Bank of Canada governor Mark Carney warned that central banks may cut interest rates more slowly and by less than many expect, as monetary policy adjusts to a new era defined by structurally higher /n./nSpeaking

FED'S RATE-CUT CONFIDENCE WOBBLES AS INFLATION DATA MISBEHAVES

Yahoo Finance - Howard Schneider (2024-04-10)

Since the March 19-20 policy meeting, members of the Fed's rate-setting committee, including two governors and two regional reserve bank presidents, have detailed concerns about the inflation path, a sizeable group in a consensus-minded organization that realizes the symbolic weight the start of policy easing will have on markets and,

BANK OF CANADA SEEN KEEPING RATES ON HOLD

Yahoo Finance (2024-04-10)

"The key points to watch on Wednesday will be how Governing Council characterizes inflation and how their discussions about the near-term path of policy have evolved," Royce Mendes, head of macro strategy for Desjardins Group, wrote in a note.

BANK OF CANADA TO HOLD AS IT DEBATES WHEN TO START EASING RATES

Bloomberg (2024-04-10)

The Bank of Canada is likely to leave interest rates unchanged and avoid signaling that cuts are imminent, as officials continue to assess the right moment to launch into easier monetary policy. Markets

US WEIGHS BAN ON CHARGING HOMEBUYERS FOR LENDER TITLE INSURANCE

Bloomberg - Austin Weinstein and Katanga Johnson (2024-04-10)

A top US consumer watchdog is considering whether to bar mortgage bankers from charging homebuyers for title insurance that protects the lenders, ending a long-standing industry practice. The

AS US BANK PROFITS DROP, FOCUS SHIFTS TO INTEREST INCOME OUTLOOK

Reuters - Nupur Anand (2024-04-10)

Goldman Sachs (GS.N),

CANADIAN MORTGAGES JUST HAD ONE OF THE SLOWEST QUARTERS EVER

Better Dwelling (2024-04-10)

Itâs also a predictable (and desired) impact from elevated interest rates.

U.S. BANK CONSOLIDATION ON PAUSE, FOR NOW

Investment Executive - James Langton (2024-04-10)

âThe decreased appetite was inevitable as the combination of higher interest rates (depressed the value of investment securities and fixed-rate loans), lower valuations (mismatched buyer/seller valuation expectations), and macro uncertainty (regional bank failures/potential recession) drove banks to the sidelines,â Morningstar noted.

ROYAL BANK OF CANADA’S RY-TDECISION TO TERMINATE NADINE AHN WILL COST THE BANK’S NOW-FORMER CHIEF FINANCIAL OFFICER MILLIONS OF DOLLARS

G&M (2024-04-09)

RBC said Friday that it terminated Ms.

HOUSING CRISIS TO REACH 'EVEN MORE ALARMING LEVELS' IF MORE ISN'T DONE

Yahoo Finance - Alicja Siekierska (2024-04-09)

According to RBC, housing construction would need to increase by nearly 50 per cent from current levels "just to meet future demographic growth."

FED'S BOWMAN SAYS TIME HASN'T ARRIVED FOR CUTTING RATES

Yahoo Finance - Michael S. Derby (2024-04-09)

For now, âour monetary policy stance is restrictive and appears to be appropriately calibrated to reduce inflationary pressures,â Bowman said.

HSBC TAKES $1 BILLION HIT FROM ARGENTINA SALE AS ASIA PIVOT CONTINUES

Yahoo Finance - Rishav Chatterjee and Lawrence White (2024-04-09)

"Argentina has been a problematic market for HSBC in recent years given hyperinflation in the region and a sharp currency devaluation, which has resulted in significant earnings volatility for the business," said Gary Greenwood, analyst at Shore Capital.

BULLARD SAYS THREE FED RATE CUTS THIS YEAR IS ‘BASE CASE’

Bloomberg - Katia Dmitrieva and Haslinda Amin (2024-04-09)

Former Federal Reserve Bank of St.

WITH NO PAY, PAKISTAN’S FINANCE MINISTER LEAVES BANKER LIFE BEHIND TO FIX ECONOMY

Bloomberg - Faseeh Mangi (2024-04-09)

Pakistanâs new finance minister is on a mission to fix his country.

EURO ZONE BANKS LOWER BAR ON MORTGAGES BUT DEMAND KEEPS FALLING

Reuters (2024-04-09)

Banks eased their standards for approving loans to households for house purchases in the three months to March and tightened access to corporate credit less than they had expected. But

CANADA TO CUT INTEREST RATES BEFORE US AS LABOR MARKET ERODES

Better Dwelling (2024-04-09)

Canadaâs economy traditionally moves very closely with the US, but it may no longer be able to do so.

CRA’S FOCUS ON REAL-ESTATE AUDITS PAYING OFF

Investment Executive - Michael McKiernan (2024-04-09)

The CRA increased its focus on non-compliance in major centres such as the Greater Toronto Area and B.C.âs

TRUMP’S STOCK OFFICIALLY DOWN 50% SINCE FIRST-DAY PEAK —TRUMP’S STAKE DOWN OVER $3 BILLION

Forbes - Derek Saul (2024-04-09)

$40 million to $90 million.

PRESS CONFERENCE: MONETARY POLICY REPORT

BOC - Tiff Macklem, Carolyn Rogers (2024-04-09)

Live tomorrow 10:30 ET.

BANK OF CANADA EXPECTED TO HOLD RATES, BUT COULD SIGNAL POLICY SHIFT

G&M (2024-04-08)

The Bank of Canada is widely expected to keep interest rates steady this week for the sixth consecutive time, although analysts are watching for a shift in tone that could open the door to rate cuts over the summer. The

RBC TERMINATES CFO AFTER PREFERENTIAL TREATMENT FOR VP IN UNDISCLOSED RELATIONSHIP: SOURCES

G&M (2024-04-08)

Royal Bank of Canada terminated chief financial officer Nadine Ahn after an employee complaint sparked an internal investigation that concluded she influenced promotions and pay raises of a vice-president in the bankâs treasury department while having an undisclosed personal relationship with him, according to three sources familiar with the matter./nThe

LOANING MONEY COMES WITH PSYCHOLOGICAL STRINGS ATTACHED

G&M (2024-04-08)

Neither a borrower nor a lender be.â

U.S. INVESTORS SUCCESSFULLY DEMAND RBC CHANGE HOW IT REPORTS ON GREEN, FOSSIL FUEL INVESTMENTS

CBC - Anis Haydari (2024-04-08)

Canada's largest bank has reversed course on a policy to disclose how much it invests in green energy versus fossil fuel energy following demands from New York City's large public pension funds, with environmental groups welcoming the move but pointing out it doesn't actually reduce carbon emissions yet.

CANADA'S UNEMPLOYMENT RATE JUMPS TO 6.1%, RAISING BETS FOR JUNE RATE CUT

Yahoo Finance - Alicja Siekierska (2024-04-08)

The increase in unemployment, up 0.3

CRYPTO-TRADING PLATFORM COINBASE SECURES REGISTRATION LICENCE IN CANADA

Yahoo Finance (2024-04-08)

Canadian regulators have cleared crypto-trading platform Coinbase to do business in the country as a restricted dealer.

RBC’S MCKAY SEES CANADA RATE CUTS STARTING IN SUMMER MONTHS

Bloomberg - Christine Dobby (2024-04-08)

Royal Bank of Canada Chief Executive Officer Dave McKay says interest rate cuts in Canada are likely to start within months, though he cautions they wonât give the economy an immediate boost. âWeâre

NIGERIA’S EX-CENTRAL BANK BOSS PLEADS NOT GUILTY TO NEW CHARGES

Bloomberg - Emele Onu (2024-04-08)

Former Central Bank of Nigeria Governor Godwin Emefiele pleaded not guilty Monday to new allegations of foreign-currency infractions brought against him by one of the countryâs finance watchdogs. The

WHY THE LOSS OF HSBC LEAVES CANADA'S MORTGAGE MARKET LESS TRANSPARENT

FP - Robert Mclister (2024-04-08)

Before RBCâs takeover, HSBC was routinely Canadaâs most aggressive, transparent lender.

IAPW EXPECTS SMOOTH TRANSITION FOR LAURENTIAN ADVISORS

FP - Katie Keir, Melissa Shin (2024-04-08)

Elliott said iAPW and Laurentian use a lot of the same vendors, including Croesus.

HOW MUCH BIG FOUR INSURANCE CEOS MADE IN 2023

Investment Executive - Jonathan Got (2024-04-08)

Roy Gori Manulife $5.1M,

News feed

CANADA WILL FINALLY ALLOW BANKS TO SHARE DATA ABOUT CROOKED CLIENTS TO COMBAT FINANCIAL CRIME

G&M - Rita Trichur (2024-04-19)

As outlined in the federal budget, Ottawa plans to increase permissible information sharing among financial institutions so that they can better detect and deter money laundering, terrorist financing and sanctions evasion. At

MORE TD BANK SHAREHOLDERS DEMAND 'CREDIBLE' DETAILS ON CLIMATE CHANGE PLANS

Yahoo Finance - Jeff Lagerquist (2024-04-19)

The proposal received support from 28.6

TFSAS, RRSPS AND MORE COULD SEE CHANGES IN ALLOWED INVESTMENTS

Melissa Shin (2024-04-19)

Holding a non-qualified or prohibited investment can lead to severe tax consequences: the plan would incur a 50% tax on the fair market value of the non-qualified or prohibited investment at the time it was acquired or changed status, and the investmentâs income also would be taxable.

HIGH-SPEED TRADER JANE STREET RAKED IN $4.4BN AT START OF 2024

FT - Eric Platt (2024-04-19)

Jane Streetâs quarterly trading revenues have surged to their highest level since the start of the pandemic, as the secretive high-speed firm flourished alongside traditional Wall Street market makers. The

News feed

FSIM briefings and developments reports

UK SMART DATA ROADMAP UNVEILED

Kevin Hollinrake, UK Minister of State for Enterprise, Markets, and Small Business, said: “The data economy is a large and growing part of the economy. Smart Data unlocks data for individuals and businesses that is currently held and underutilized in a small number of existing companies. It allows businesses to easily access this data, with consumers consent, to provide new services that drive investment, productivity, competitive outcomes and ultimately economic growth.”

BLACKSTONE WARNS THAT PRIVATE EQUITY CANNOT RETURN CAPITAL ‘OVERNIGHT’

Blackstone has said it will take time for private equity firms, which are sitting on record amounts of unsold assets, to return cash to investors even as the market for mergers and acquisitions comes back to life. “I think we’re still in the early stages of the recovery phase that will ultimately allow private equity investors to return capital. It doesn’t happen overnight,” Jonathan Gray, president of Blackstone, told the Financial Times in an interview. The world’s largest private equity group expects a rebound in dealmaking as financial markets loosen after two years of muted initial public offering and takeover activity caused by rising interest rates and geopolitical tumult. Gray said Blackstone was “definitely seeing more transaction activity”, helped by lower corporate borrowing costs and a pick-up in bond issuance even as investors have curbed their expectations for central bank rate cuts. Private equity groups such as Blackstone expect that falling interest rates will spur an increase in dealmaking that will allow the industry to exit $3tn of unsold private company investments. That, in turn, will allow them to return cash to large pension funds that are at present overexposed to unlisted investments and retrenching from making new private market bets. Strong economic data in the US and mounting tensions in the Middle East have pushed back the date when the US Federal Reserve is expected to cut rates. Fed chair Jay Powell said on Tuesday it was likely to take “longer than expected” for inflation to reach the target level that would allow the central bank to cut rates. Gray said he was confident financial markets would shrug off a slower than expected rate-cutting cycle. “I think, over time, the Fed will get some better data, it will give them room to cut rates. But the pace of that disinflation has slowed,” he said. Gray’s comments came as Blackstone reported slightly better than forecast first-quarter earnings, which showed a significant increase in new investments, but a 17 per cent decline in the assets it was able to sell. The New York-based group more than doubled the amount of investments it made to $25bn from $11bn a year ago. But it was able to sell just $15bn in investments, a steep decline from the $18bn of assets it sold in the first quarter of 2023. The group’s results were buoyed by strong growth in its credit and insurance business, which has $330bn in assets and helped propel Blackstone’s overall assets to $1.1tn. Wealthy individual investors also poured more than $8bn into Blackstone’s funds, including $2.7bn for a recently launched private equity fund targeting so-called retail investors. Gray also forecast market conditions would continue to improve despite the uncertainties of wars in Europe and the Middle East, and the upcoming US presidential elections. “There have been so many geopolitical shocks in recent years . . . people are a little bit more desensitised,” he said.

HIGH-SPEED TRADER JANE STREET RAKED IN $4.4BN AT START OF 2024

Jane Street’s quarterly trading revenues have surged to their highest level since the start of the pandemic, as the secretive high-speed firm flourished alongside traditional Wall Street market makers. The group expects its first quarter net trading revenue will be roughly $4.4bn, more than double the level it achieved a year prior and up 35 per cent from the end of 2023, according to documents reviewed by the Financial Times. The blockbuster figures underscore how Jane Street has quietly emerged as a trading powerhouse of global financial markets, out-earning a number of big rivals and banks. The New York-based company estimated it earned net income of about $2.7bn in the quarter, giving it a net profit margin of more than 60 per cent. The sum lifted profits over the past 12 months to roughly $7.4bn. The firm, which trades tens of thousands of products, including currencies, exchange traded funds and options, reported profits of $5.9bn in 2023 and $6.7bn in 2022. Jane Street noted in the document that the first-quarter figures had not yet been audited and could change. The firm declined to comment to the FT. The documents reviewed by the FT also showed how large of a player Jane Street has become in cryptocurrency markets, turning over more than $200bn worth of the coins over the past three years. Bitcoin trading has leapt this year following the US launch of ETFs tracking the cryptocurrency. Spot volumes had jumped 44 per cent by the end of February from the end of 2023, according to a March presentation by rival trading firm Virtu. Jane Street and Virtu play a pivotal role providing liquidity to the new ETFs as authorised participants. Jane Street’s results were disclosed to potential lenders as part of its efforts to raise $1.4bn in bond markets on Wednesday, capital that will allow it to continue to expand. Strong investor demand meant the market maker could borrow more than the $1.25bn it had initially planned to raise, and it locked in a 7.15 per cent interest rate on the 2031 maturing debt, according to a person briefed on the matter. The company — founded in 2000 by three veterans of trading firm Susquehanna and a former IBM developer — has broadened its financing sources in recent years, taking out a loan from institutional investors and establishing a revolving credit facility with JPMorgan.