Canadian bank industry overview - part 1 |

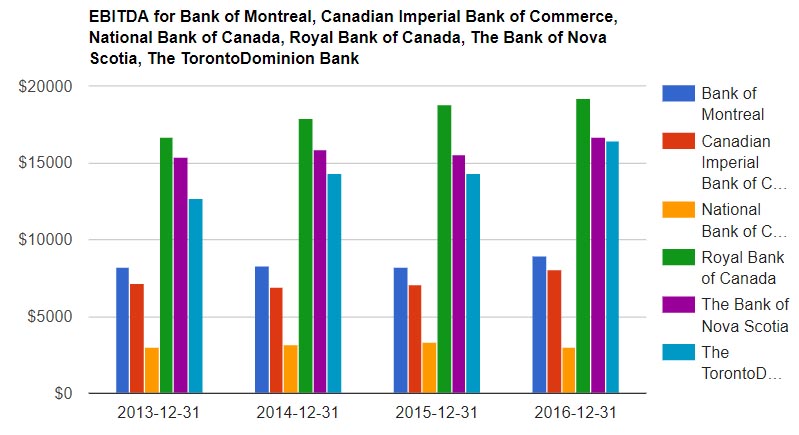

Large banks

Large banks have revenue between $4 and $20 billion.

Banks in this category include TD, RBC, Scotia, CIBC, BMO and National

Bank. Desjardins is not included as it is a cooperative.

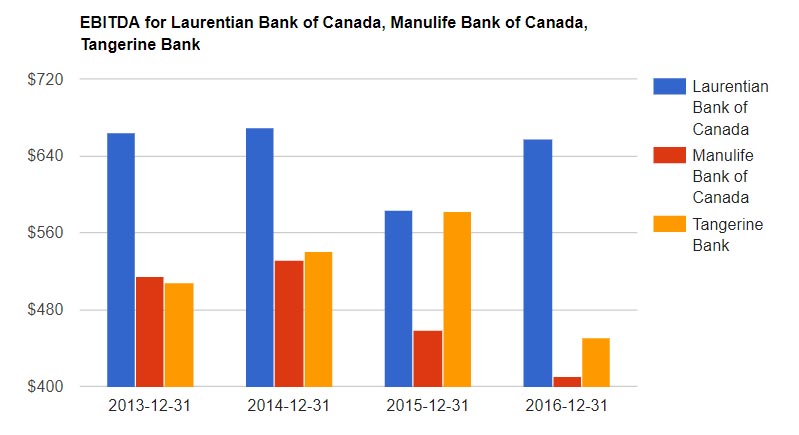

Mid-large banks

Revenue for mid-large banks ranges from $400 to $650 million.

Banks include Laurentian, Manulife and Tangerine.

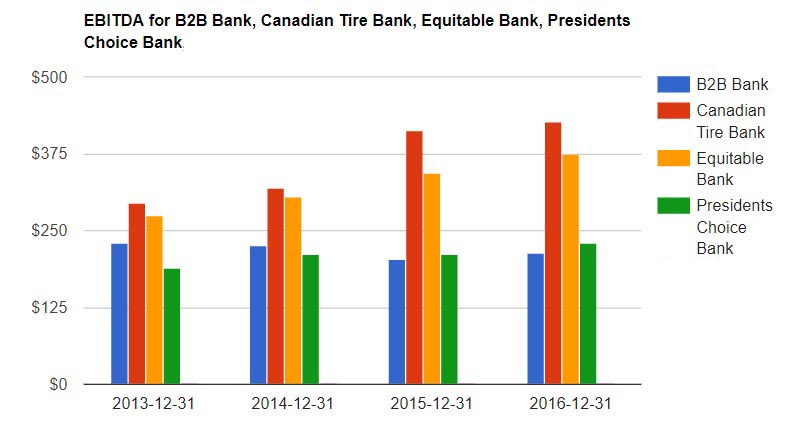

Mid-size banks

This category of banks include B2B, Canadian Tire, Equitable, Presidents

Choice and Wealth One

Revenue for mid-sized banks ranges from $170 to just under $400 million.

Small-mid banks

This category includes Caisee Populaire Acadianne, Hollis, Home Equity and

Versabank.

Revenue for this category ranges from $40 to just over $120 million.

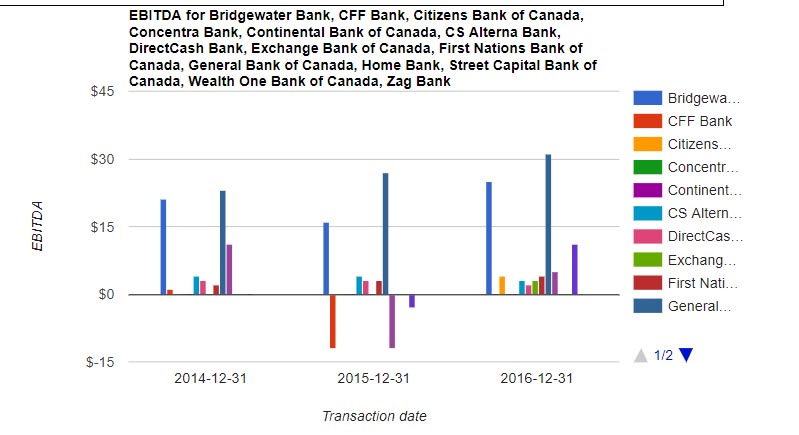

Small banks

This category includes the likes of Bridgewater and CFF to Zag Bank.

Revenue for small banks ranges from negative to $30 million

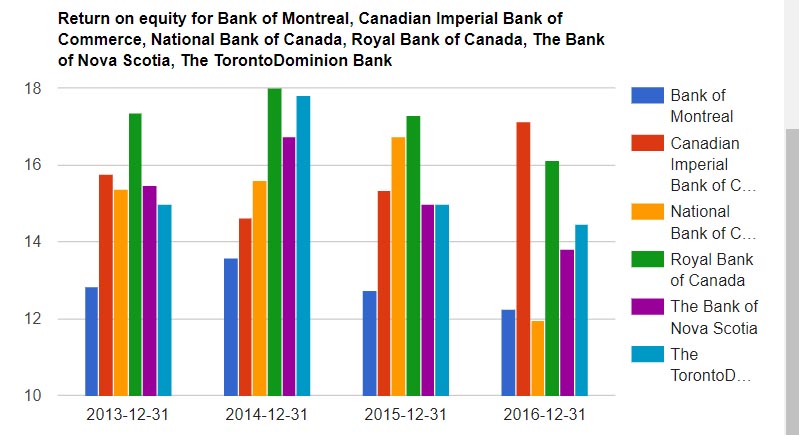

ROE large banks

Large bank return on equity (ROE) ranges from 12 per cent to 18 per cent.

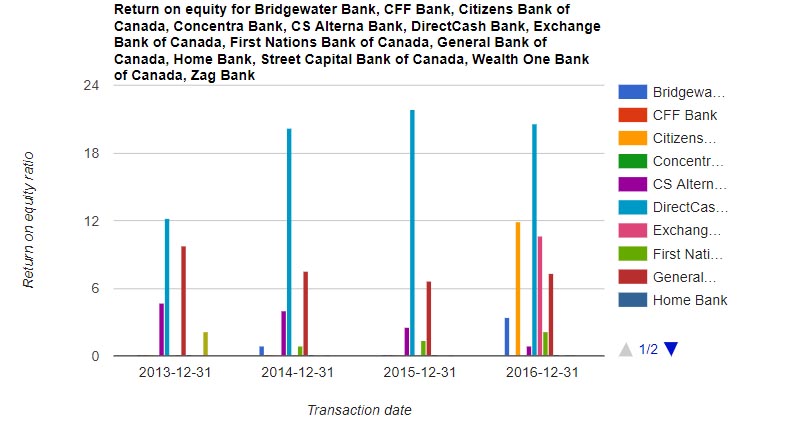

ROE small

Small bank ROE is typically below 6 per cent, but variations, such as

Direct Cash at 18% are not surprising.

Comment

Google plus